10 Powerful eCommerce Data Collection Strategies & Examples

Perfect real estate data aggregation is the key to building powerful marketplaces. By consolidating accurate, up-to-date data, platforms improve search functionality, deliver reliable information, and enhance user experience, driving growth, user trust, and long-term competitiveness.

With most property searches now conducted online, the importance of real estate data collection—encompassing listings and prices to trends and forecasts—cannot be overstated. As property marketplaces continue to evolve, data aggregation will play a pivotal role in shaping competitive tech-driven platforms.

Table of Contents

Real estate marketplaces are transforming how buyers, sellers and investors interact, revolutionizing property transactions. Accurate data aggregation is essential for building powerful marketplaces and enabling seamless transactions and more informed decisions. Service providers specializing in real estate data aggregation ensure that these platforms have access to the high-quality, organized data they need to thrive.

In this article, we’ll explore how real estate data aggregation enhances marketplace functionality, shapes the future of property platforms, and addresses the challenges of managing vast amounts of property data.

Readers will learn how expert data aggregation service providers and perfect real estate data aggregation can create more powerful, reliable and visually appealing real estate platforms.

Real estate data aggregation involves collecting, organizing and managing vast amounts of property related data from a wide plethora of sources into a unified platform. This process ensures that real estate information is accurate and easily searchable and accessible, thanks to advanced algorithms and machine learning models.

Given the sheer volume of data, automation is key to efficiently aggregating, processing and updating information in real time. Automating tasks such as data collection, verification and enrichment is essential for maintaining accuracy, reducing manual errors, and ensuring consistency across platforms. Discover the 5 tasks real estate data aggregators should automate and how. They can enhance platform reliability.

Perfect data aggregation is vital for real estate marketplaces, providing data-driven insights that lead to informed decisions, smoother transactions and efficient property searches. In contrast, inaccurate data can result in missed opportunities and erode user trust.

Key components of real estate data aggregation include:

Now that we’ve covered the fundamentals of real estate data aggregation, let’s talk about the five key ways that perfect data aggregation helps build a powerful, competitive marketplace.

Aggregated data consolidates property-related information from various sources, enabling real estate marketplaces to offer advanced search and discovery features. With perfect data aggregation, platforms can implement detailed filters, such as property type, price range, location and features like proximity to schools or public transport. This level of customization allows for personalized recommendations that cater to individual preferences.

Advanced search capabilities are also powered by machine learning and predictive analytics, which analyze user behavior to suggest properties based on previous searches or browsing patterns. Additionally, geospatial data integration allows users to explore properties on interactive maps, showing nearby amenities and neighborhood features, creating an immersive experience.

Real-time data aggregation enables faster and more accurate search results, reducing the time spent browsing and helping users find relevant properties more efficiently. Platforms like Zillow and Realtor.com use these advanced techniques to offer tailored property suggestions, leading to higher user engagement and satisfaction.

By integrating data-driven insights and AI-powered recommendations, real estate marketplaces can significantly improve the search experience, making it more intuitive and efficient, ultimately building a powerful, competitive platform.

Accurate and reliable information is essential for building a powerful real estate marketplace. When users trust the data—whether it’s property listings, pricing, or neighborhood insights—they are more likely to engage with the platform and make informed decisions. This trust is the foundation for user loyalty, repeat visits, and successful transactions. A marketplace that consistently provides reliable information fosters confidence among buyers, sellers and investors, enhancing the overall credibility and strength of the platform.

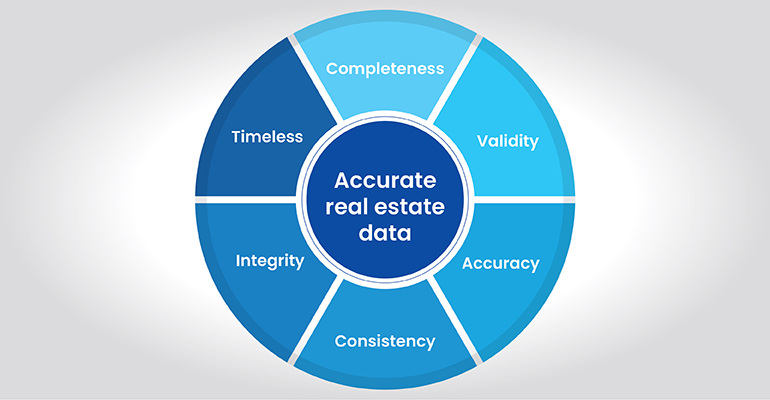

To ensure data accuracy, real estate marketplaces must source information from trusted, verified sources such as MLS, public databases, and reputable partners. Regular updates and cross-referencing with multiple sources help maintain data consistency, while validation methods like deduplication and real-time quality checks minimize errors. These processes are crucial for ensuring that the platform’s content remains reliable and up to date.

By providing accurate, transparent information, real estate platforms reduce the risk of misinformation, empowering users to make informed decisions with confidence. This commitment to accuracy fosters trust, strengthens user engagement, and ultimately builds a more competitive marketplace capable of scaling and thriving in the long term.

Comprehensive market coverage is critical for building a successful real estate marketplace. By aggregating data from multiple trusted sources—such as MLS, local agencies, public records, and private databases—the platform offers a broader range of property listings, services and market insights. This comprehensive approach appeals to a diverse audience of buyers, sellers, renters and investors by addressing their varied needs within a single platform.

Aggregating data from diverse sources not only broadens the range of property listings, but also enriches the platform with detailed market trends, neighborhood data, and property histories. This holistic view caters to multiple user segments, allowing them to make well-informed decisions about whether they’re looking to buy, rent or invest. The depth and diversity of data provide a competitive edge, attracting more users and increasing transaction volumes.

Additionally, extensive coverage enhances the platform’s credibility and user trust by offering a complete, transparent picture of the market. With fewer gaps in information, users can confidently rely on the platform, reducing the need to turn elsewhere for supplemental research.

For example, the aggregation of over 40 million real estate records annually, each record enriched with property attributes and features, led to improved operational profitability for a US-based property data solutions provider. This all-inclusive approach strengthens the marketplace, making it an essential tool for real estate professionals and consumers alike.

A real estate marketplace with well-organized, relevant and easily accessible property data significantly enhances user engagement. When users can quickly find detailed property listings, accurate pricing, and up-to-date market trends, they are more likely to spend time on the platform, boosting engagement and retention rates. Features such as streamlined navigation, advanced search filters, and personalized recommendations further improve the user experience, making interactions more efficient and satisfying.

Data-driven tools—like tailored property suggestions and real-time market insights—keep users engaged, increasing repeat visits and the likelihood of transactions. By offering accurate, easily navigable data, platforms reduce user frustration and build trust, encouraging users to explore more and return frequently.

Platforms like Redfin and Trulia demonstrate how prioritizing organized, accessible data can lead to increased user engagement and customer loyalty. By ensuring that the platform is intuitive and user-friendly, real estate marketplaces can foster deeper engagement, driving long-term growth and marketplace success.

A marketplace that leverages perfect data aggregation gains a substantial competitive edge. By consolidating vast amounts of accurate, relevant property data, the platform can offer features that differentiate it from its competitors. Advanced analytics tools, powered by aggregated data, allow users to explore market trends, compare prices, and assess investment opportunities in real time. Personalized recommendations tailored to individual preferences further enhance the user experience, making the platform more engaging and user-friendly.

These features, driven by robust data aggregation, result in a more comprehensive product offering. Users benefit from having access to a wealth of information—property listings, neighborhood insights, pricing trends, and user reviews—all in one place. This not only attracts new users but also helps retain existing ones by offering a superior, more efficient property search experience.

Marketplaces like Realtor.com and Redfin have gained a competitive advantage by implementing superior data aggregation strategies. Features such as predictive pricing models, personalized recommendations, and in-depth market analytics help them stand out in a crowded market and continuously attract more users. In an increasingly competitive real estate industry, data aggregation is a key differentiator that drives growth and ensures long-term success.

Ready to build a powerful real estate marketplace?

Real estate marketplaces rely heavily on aggregated property data to provide users with a seamless and efficient property search experience. Utilizing aggregated property information empowers real estate marketplaces to provide a more dynamic, accurate and user-centric property platform, leading to higher engagement and better user satisfaction.

Key ways real estate marketplaces utilize aggregated data include:

While real estate data aggregation offers immense benefits, it also presents several challenges that marketplaces must overcome to deliver a seamless and reliable user experience. Below are five key challenges that can impact the efficiency and effectiveness of data aggregation:

Want to tackle these challenges head-on?

To ensure successful data aggregation in real estate marketplaces, adopting best practices is essential for optimizing data quality, integration and performance. The following are key strategies that can help create an efficient and scalable data aggregation process:

As technology continues to evolve, the future of real estate data aggregation will be shaped by advancements that promise to enhance data accuracy, integration and user experience.

The future of real estate data aggregation will be shaped by technological advancements that enhance accuracy, integration and user experience. AI and machine learning will automate data aggregation and enable predictive analytics for trends and pricing. Blockchain will boost data security and transparency, while real-time data streams will offer instant updates via APIs and IoT.

Geospatial data and AR will provide immersive virtual property experiences. With stricter regulations like GDPR and CCPA, data privacy will be prioritized. These trends will create more dynamic, efficient and secure real estate marketplaces.

Perfect data aggregation is the foundation for building powerful real estate marketplaces. By consolidating comprehensive, accurate and up-to-date data, platforms can offer seamless search functionality, reliable information, and personalized recommendations that enhance the user experience. Prioritizing data aggregation is not just a technical necessity, but a strategic move to drive growth and competitiveness in an increasingly data-driven real estate industry.

Marketplaces that focus on effective data aggregation can differentiate themselves by providing superior service, attracting more users and retaining customer loyalty. Addressing challenges such as data quality, integration and real-time updates is essential for creating a trusted platform.

For those looking to dig deeper into data practices, exploring detailed guides on data collection is crucial, as it forms the basis of any successful aggregation strategy. For more insights, check out a detailed guide to data collection for data aggregators, which provides essential techniques and strategies for collecting high-quality data.

Ultimately, by investing in robust data aggregation strategies, real estate marketplaces can position themselves for long-term success and deliver more value to their users.

What’s next? Message us a brief description of your project.

Our experts will review and get back to you within one business day with free consultation for successful implementation.

Disclaimer:

HitechDigital Solutions LLP and Hitech BPO will never ask for money or commission to offer jobs or projects. In the event you are contacted by any person with job offer in our companies, please reach out to us at info@hitechbpo.com

Leave a Reply