10 Powerful eCommerce Data Collection Strategies & Examples

Poor real estate data quality doesn’t just drain your finances. It erodes your credibility and trust in the market. Bad data leads to lost revenue, diminished reputation, and missed opportunities to stay competitive. Investing in robust property data quality isn’t just a solution; it’s a strategy.

Table of Contents

Real estate data quality challenges have grown from operational inconveniences to significant financial liabilities, directly affecting strategic decisions and market competitiveness. Real estate firms are more vulnerable due to their reliance on precise property valuations, ownership records, and market analytics. The industry’s core challenge is the prevalence of flawed, inconsistent and unreliable information affecting daily operations.

The solution lies in systematic real estate data quality management, which addresses financial stability, operational efficiency and market reputation. By implementing standardized data collection frameworks backed by strong data validation protocols, real estate companies can significantly reduce mispricing incidents, minimize transaction failures, and streamline their operational workflows.

Improved real estate data quality delivers immediate, measurable benefits in the form of reduced manual corrections, accelerated deal closures and strengthened market credibility. Real estate professionals who prioritize data accuracy not only minimize revenue leakage but also gain competitive advantages. This article examines the comprehensive impact of poor data quality and outlines strategic approaches to mitigating these challenges.

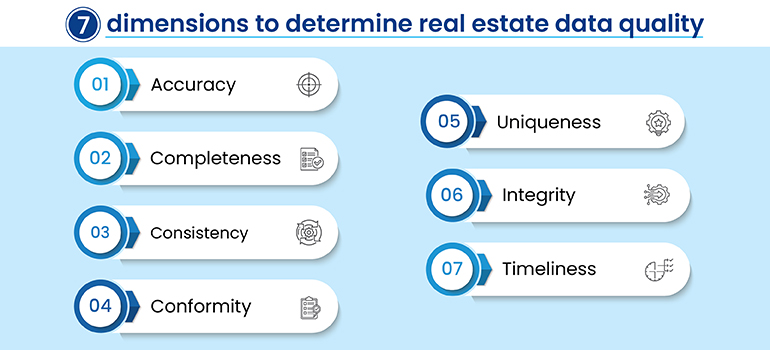

Defining real estate data quality goes beyond simply having data; it’s about having the right data. High-quality real estate data is accurate, reflecting true property details and market conditions, complete, with no missing information, timely, updated regularly to reflect current trends, and consistent across various platforms and sources.

It encompasses diverse data types, from property specifics like square footage and lot size to broader market trends, buyer and seller demographics, and financial records.

However, this critical real estate data tends to get dirty. Poor data quality manifests in various ways. Imagine incomplete property records missing crucial details, such as the number of bedrooms, outdated market trends leading to inaccurate pricing strategies, or flawed valuations causing financial losses.

According to the National Association of Realtors, 39% of buyers consider detailed property information to be one of the most valuable features when searching online. With such a significant portion of population, relying on these details, the importance of accuracy in online listings cannot be overstated.

Inaccuracies erode trust, hinder informed decision-making, and ultimately lead to direct and indirect financial implications that this article aims to explore.

Is inaccurate real estate data costing you time, money and reputation?

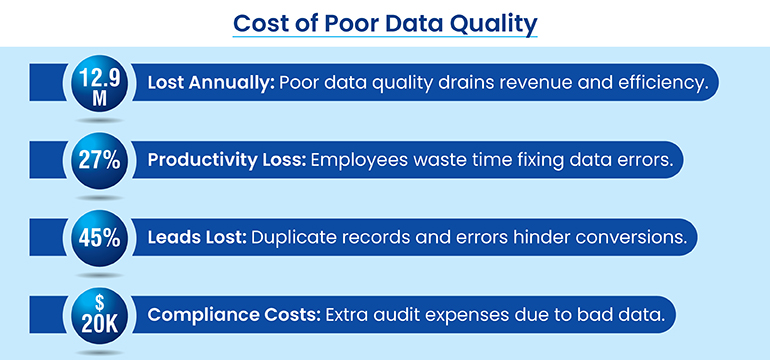

The hidden costs of poor real estate data quality extend beyond simple errors; they affect multiple facets of business operations. Let’s now talk about the ways and means in which poor data quality incurs unnecessary expenses, erode trust, and hinder strategic decision making.

| Impact Area | Specific Issues | Consequences |

|---|---|---|

| Financial Implications | Mispricing, transaction failures, data correction costs. | Lost profits, increased expenses, reduced credibility. |

| Operational Costs | Workflow inefficiencies, resource allocation, customer dissatisfaction. | Wasted time, higher costs, damaged client relationships. |

| Legal & Compliance Risks | Zoning errors, inaccurate records, privacy violations. | Fines, lawsuits, license revocation risks. |

| Reputational Costs | Client trust erosion, brand damage, negative word-of-mouth. | Loss of clients, damaged credibility, reduced market share. |

| Strategic Consequences | Poor investment decisions, reduced competitiveness, missed opportunities. | Stagnant growth, loss of market share, missed potential. |

The integrity of data directly impacts profitability, operational efficiency and market credibility. Poor data quality can lead to significant financial setbacks, from valuation inaccuracies to transaction failures and escalated operational costs. Here are the specific ways in which poor data quality translates into direct financial losses:

Financial losses due to mispricing and valuation errors

Mispricing arises when inaccurate or incomplete data skew property valuations. For instance, overvalued properties struggle to attract buyers, causing prolonged market presence and lost opportunities. Conversely, undervalued assets sell below potential, reducing profitability.

Case studies abound where incorrect square footage, missing amenities, or outdated market data led to valuation errors, distorting appraisals and diminishing market competitiveness. Such errors ripple across stakeholders, from agents to investors, shaking confidence in the market’s integrity and further emphasizing the far-reaching consequences of poor data quality. A data entry error in Zillow’s AI algorithm overestimated home values, leading to unsustainable purchases and a significant financial write-down of $569 million.

Revenue leakage from transaction failures

Incomplete or incorrect data, such as inaccuracies in property ownership or zoning details, can derail deals. These failures lead to buyer and seller frustration, eroding trust and causing financial loss through missed commissions or penalties. For example, transactions delayed due to erroneous legal records or incomplete compliance checks often result in lost revenue and reputational harm.

Increased costs to rectify data errors

Correcting data errors after transactions can be resource intensive. Companies often rely on manual labor to identify and fix inaccuracies, significantly increasing operational expenses. Additionally, inefficiencies in lead generation, property management, and client profiling limit growth opportunities.

Each error not only drives up costs but also results in missed revenue from deals that could have been closed with accurate data. Implementing robust data quality solutions alongside optimized data entry processes can help mitigate these challenges, streamline operations, and unlock untapped growth potential.

Operational inefficiencies caused by poor data quality have a cascading effect on real estate businesses. These challenges lead to wasted resources, reduced productivity and increased costs, ultimately impacting profitability and customer trust. Below is a breakdown of how these costs manifest across different operational areas:

Inefficiencies in daily workflows

Inaccurate or incomplete data create bottlenecks in daily operations, slowing productivity. For instance, time is wasted on reconciling incorrect or missing information that could otherwise be spent on value-driven tasks. Scheduling property viewings becomes chaotic when available data is outdated, leading to client dissatisfaction and missed opportunities. These inefficiencies directly affect the speed and effectiveness of critical processes.

Resource allocation for data correction

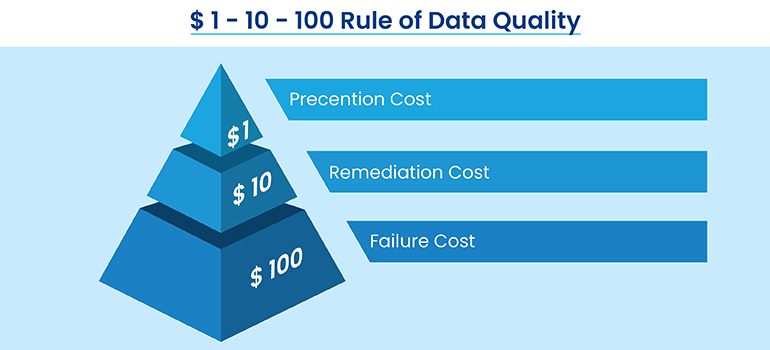

Fixing data errors demands substantial resources, both financial and human, that could otherwise be invested in growth initiatives. The 1:10:100 rule states that preventing a data error costs $1, correcting it costs $10, and leaving it uncorrected costs $100. Investing in data quality early prevents costly downstream issues.

Continuous auditing and error correction result in hidden costs that accumulate over time. This diversion of resources hampers innovation and puts unnecessary strain on operational budgets.

Impact on customer satisfaction

Clients rely on accurate data for their property transactions, and errors can lead to frustration and mistrust. Incorrect property details, delays in communication or mismatched expectations result in poor client experiences. This can lead to adverse word-of-mouth opinions, damaging the company’s reputation and affecting future business opportunities.

The real estate industry operates within a complex web of legal and regulatory frameworks designed to ensure fair, transparent and lawful transactions. Here is a quick overview of the legal frameworks governing real estate transactions.

Key regulations include:

Failing to adhere to these laws can result in severe legal and financial consequences for real estate businesses. For example, failure to comply with data privacy regulations like GDPR can lead to hefty fines.

Compliance violations

Poor-quality data significantly increases the risk of regulatory breaches. Common examples include:

Litigation risks

Errors in real estate data can escalate into costly legal battles, including:

Legal and compliance risks stemming from poor data quality are not just theoretical, they are a tangible threat to the profitability and reputation of real estate firms. By ensuring data accuracy and adhering to legal frameworks, businesses can safeguard themselves against costly penalties, lawsuits and reputational damage.

Poor data quality can significantly damage the trust and credibility of a real estate company. These reputational costs extend beyond financial losses, affecting client relationships and market standing. Below are key areas where poor data quality impacts reputation:

Client trust and retention

Clients depend on accurate property data to make informed decisions. Errors, such as incorrect property details or misrepresented valuations, lead to dissatisfaction and frustration. This often results in client churn as buyers, sellers or tenants seek more reliable service providers. Over time, a lack of trust in data integrity can hinder repeat business and long-term client loyalty.

Brand reputation

Visible errors in property listings, valuations or legal documents damage professional credibility. Such mistakes create a perception of carelessness, deterring potential clients and business partners. Over time, recurring issues can erode public trust and tarnish the company’s brand image in a competitive marketplace.

Word-of-mouth impact

Negative experiences fueled by poor data quality can lead to unfavorable reviews and word of mouth. Clients sharing stories about misrepresented property data or failed transactions can significantly harm a company’s reputation. In an industry where trust is paramount, bad reviews can create a ripple effect, driving prospective clients to competitors.

Partner with our real estate data experts to clean, enrich, and maintain high-quality data.

Poor data quality in real estate doesn’t just affect day-to-day operations; it also has profound strategic implications. The lack of data accuracy in real estate can misguide investment decisions, erode market competitiveness and result in lost growth opportunities. Precise and reliable data is crucial for informed decision-making and safeguarding long-term success.

Impacts on investment decisions

Accurate data is critical for making informed investment decisions. Outdated or incomplete market analysis leads to flawed investments like overpaying for undervalued properties or missing emerging opportunities. The long-term impact of these decisions includes reduced portfolio performance and stagnation in returns, eroding investor confidence and business growth.

Reduced market competitiveness

In an era dominated by data-driven strategies, companies that fail to invest in high-quality data are quickly outpaced by their competitors. Data-savvy firms leveraging advanced analytics tools can anticipate trends, optimize pricing, and engage customers more effectively. Companies relying on poor-quality data risk losing market share and falling behind in innovation. According to a Forbes’s study, overpriced homes often linger on the market beyond 120 days and typically sell for under 90% of the original price after multiple reductions.

Lost opportunities

Poor data quality can result in missed opportunities, such as failing to close key sales or acquisitions. Real-time, accurate data enables businesses to capitalize on emerging trends and make timely decisions. Without this, organizations are left reactive rather than proactive, missing critical moments that could define their growth trajectories.

Maintaining data quality requires more than routine checks; it demands a strategic approach rooted in industry best practices. From data validation and standardization to leveraging advanced tools and technologies, data quality management in real estate ensures the foundation of your business remains strong, enabling smarter strategies and better outcomes.

| Best Practice | Key Actions | Benefits |

|---|---|---|

| Implementing Data Governance | Define roles. Set standards. Automate. | Consistency. Compliance. Streamlined operations. |

| Regular Data Audits | Periodic audits. Cleansing services. Ensure privacy. | Accuracy. Error reduction. Regulatory alignment. |

| Training and Accountability | Train teams. Assign roles. Track errors. | Proactive quality. Reduced errors. Clear ownership. |

| Real-Time Data Analytics | Monitor trends. Forecast risks. Analyze behavior. | Market insights. Strategic planning. Opportunity discovery. |

A robust data governance framework establishes clear protocols for data handling, ensuring consistency and compliance. Defining roles and responsibilities of data collection helps organizations to create a structured approach for managing data quality. Technology solutions like data management platforms further streamline operations by automating workflows and standardizing inputs.

Routine data audits are vital for identifying and resolving inaccuracies before they escalate. These checks ensure data is complete, consistent and aligned with regulatory standards. Partnering with data cleansing services can significantly enhance error detection and resolution.

Well-trained teams are the first line of defense against data errors. Providing regular training and establishing accountability ensures a proactive approach to data quality. Clear ownership roles and structured oversight reduce the likelihood of errors.

Real-time analytics empowers businesses with actionable insights, allowing them to respond dynamically to market trends. Predictive analytics further supports strategic planning by forecasting risks and opportunities. These tools enhance both decision making and long-term profitability.

Data quality management in real estate extends beyond technological solutions. It is a fundamental operational imperative that impacts financial performance, regulatory compliance, and market positioning. Organizations must prioritize comprehensive data governance frameworks, implement regular audit protocols, and maintain stringent data validation processes to ensure integrity.

Success in today’s real estate sector demands an unwavering commitment to data quality across all operational levels. This systematic approach reduces operational inefficiencies, minimizes compliance risks and strengthens market credibility. By investing in robust data management practices and leveraging advanced analytics capabilities, real estate organizations can better position themselves for sustained growth and operational excellence.

What’s next? Message us a brief description of your project.

Our experts will review and get back to you within one business day with free consultation for successful implementation.

Disclaimer:

HitechDigital Solutions LLP and Hitech BPO will never ask for money or commission to offer jobs or projects. In the event you are contacted by any person with job offer in our companies, please reach out to us at info@hitechbpo.com

Leave a Reply